(973) 948-3520

133 Route 645

Sandyston, NJ 07826

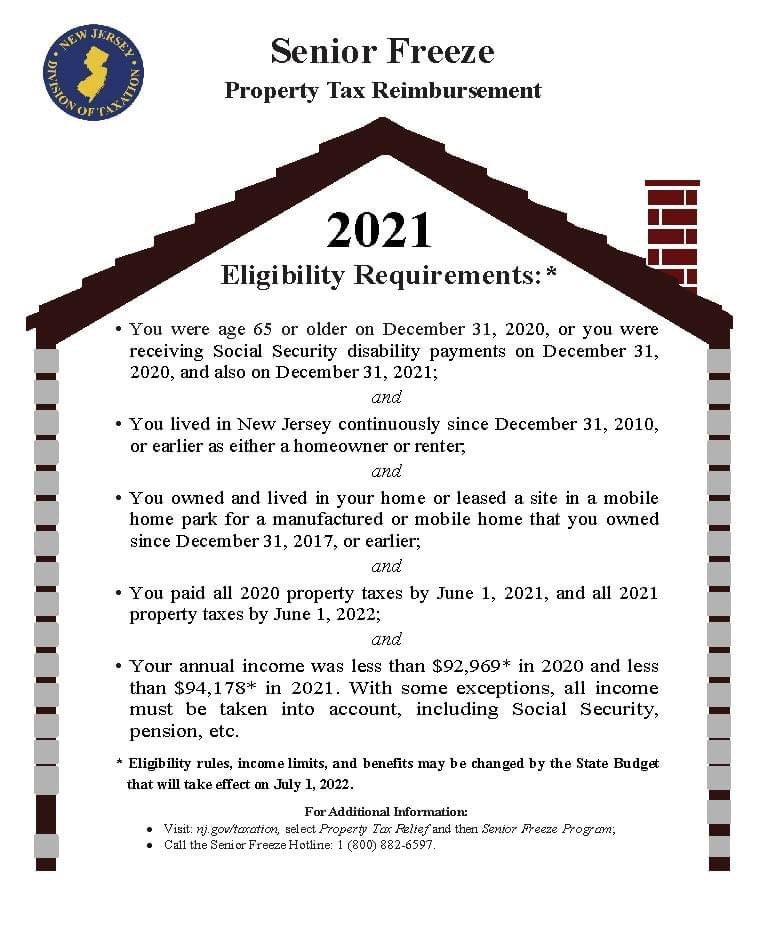

“Senior Freeze” deadline to file is 10/31/2022

“Applications for the current Senior Freeze were mailed in February, but if you didn’t get the application booklet, you can call the state at ‼️(800) 882-6597‼️. That’s important if you’ve moved because the postal service doesn’t forward the application.

When a resident first applies for the program, they create a “base year” of eligibility. The program will then “freeze” property tax increases for subsequent years.

➡️To be eligible, you or your spouse or civil union partner must have been 65 or older on Dec. 31, 2020, or receiving federal Social Security disability benefit payments on or before Dec. 31, 2020.”

➡️“You must have lived in New Jersey continuously for 10 years, since Dec. 31, 2010 or earlier, as either a homeowner or a renter.

➡️Homeowners must have owned and lived in their home — only primary residences are eligible — since Dec. 31, 2017 or earlier, and still owned and lived in the home on Dec. 31, 2021. Your property taxes for 2020 property must have been paid in full by June 1, 2021, and the 2021 property taxes must have been paid by June 1, 2022.”

➡️“You also must meet income limits. Your total annual income, if you were single or if you were married or in a civil union and lived in the same home, must have been $92,969 or less in 2020 and $94,178 or less in 2021.

The Division of Taxation said it began issuing payments on July 15 and it will continue to send payments monthly through the end of the year.”

Visit the State of NJ website for more information:

https://www.state.nj.us/treasury/taxation/ptr/index.shtml

Questions? Call Theresa Doyle, Tax Collector 973-948-3520 x202

Tuesdays 12 pm to 2 pm

Thursdays 9 am - 12 pm